He sat quietly at a side table; dignified salt and pepper hair. Conversation buzzed around him.

The discussion in the room centered around the success of a recent church capital campaign. The next step involved planning appropriate follow-up strategies for the fulfillment phase.

The suggestions were many, including one that involved legacy giving. He waited for an opportunity before speaking because he had an important story to tell.

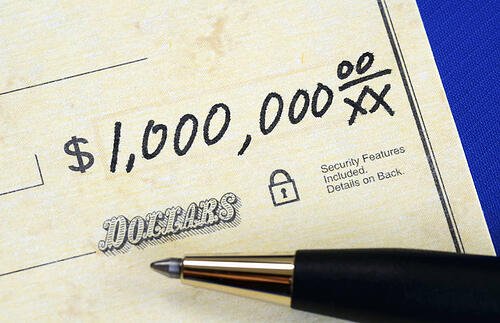

An attorney by trade, he described his experience in the estate closing of one of his clients. After receiving the proceeds from the estate sale, his client wrote a check for approximately $1,000,000. The recipient of this check? The IRS!!!

He knew this client personally as an active and supportive member of a nearby church. If his client had known (been informed better) or taken action, those funds would not have been due to the IRS. However, there was nothing in the client’s estate plan to specify any other recipient. Hence, the check had to go to the government.

You could hear a pin drop in that room!

The expressions of those around me come to mind even now! The collective question was: "Would a focus on legacy giving be beneficial for our church?" Now the answer was a resounding yes!

For decades I have heard pastors lament after learning that church members gave a large gift to their alma mater or a non-profit. The pastors ask us, "Do they not know that we could use that gift as much or more than the place where they gave it?"

Like any charitable gift, a legacy gift must be cultivated. Building relationships, casting vision, investing in your people and inviting them to partner with your church mission are part of the gifting process. Unlike regular charitable gifts, legacy giving warrants that you educate your people about it.

Pastor, if you think legacy gifts are going to appear on their own, you're wrong. Charitable organizations, other than your church missions, receive legacy gifts because those groups are working to educate people about the possibilities.

They help people to understand what can be done through their will and estate plans. They cast vision for how a legacy gift could be used in their institution to further their mission.

So, is it worth it? In 2014 alone, $28.13 billion was given in bequest gifts (almost 8% of all charitable giving that year). The average bequest gift is an estimated $35,000.

The misperceptions are many, but mostly there is silence. It’s not a topic you hear in most ministries or something you see in church materials.

I suspect that silence exists for many reasons, the main one likely being, "I don’t know anything about legacy giving, and so I can’t talk to my people about it.”

The possibilities of gift planning are immense!

Whether it's cultivating generosity or creating a legacy generosity strategy, we at  Generis are here to work with you on this aspect of Kingdom growth. Contact RustyLewis today with questions on legacy giving or how to create a generosity culture in your church.

Generis are here to work with you on this aspect of Kingdom growth. Contact RustyLewis today with questions on legacy giving or how to create a generosity culture in your church.

Share this

You May Also Like

These Related Stories

The #1 Reason Church Plants Fail

The #1 Barrier to Your Church’s Giving Potential

No Comments Yet

Let us know what you think